3x

Our specialists speed up the time it takes to complete daily and monthly reconciliations by 3x

Instantly place orders with title partners and give clients access to real-time progress updates and paperless, error-free closings

Build and deliver custom, on-brand, and modern closing experiences using Qualia’s flexible infrastructure

Scale your underwriting business with modern title agency management and operations all in one place

Leverage a turn-key distribution platform that gives you instant access to thousands of clients

Get the transparency, speed, and real-time communication you want when purchasing or refinancing a home

Related Resources

Our specialists speed up the time it takes to complete daily and monthly reconciliations by 3x

Save 20 hours a month completing painful daily & end-of-month reconciliations

Businesses save $35k* on average per year on bank fees and technology costs

* Based on a Core, Connect, & Shield professional bundle plan. Actual cost savings may vary.

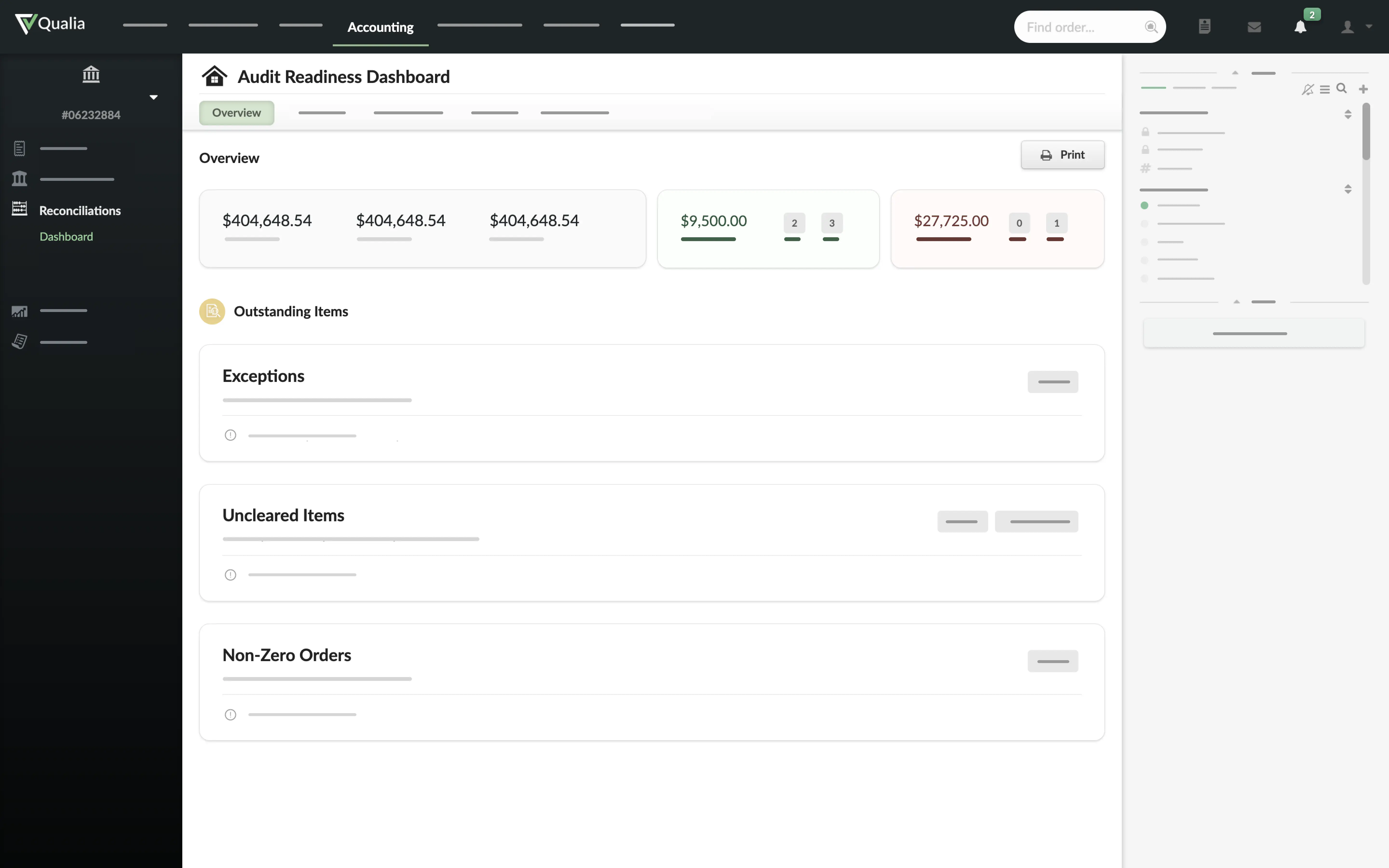

The Audit Readiness Dashboard gives you an overview of all exceptions, uncleared items, and non-zero orders for each of your bank accounts in real time.

Communicate with your Qualia Reconciliation Specialist right inside the dashboard inbox. Easily leave an audit trail with notes on accounting items. Assign tasks or tag team members when accounting items require follow up.

Take daily reconciliations off of your plate so you can focus on other high priority tasks, and get peace of mind knowing you’re audit ready.

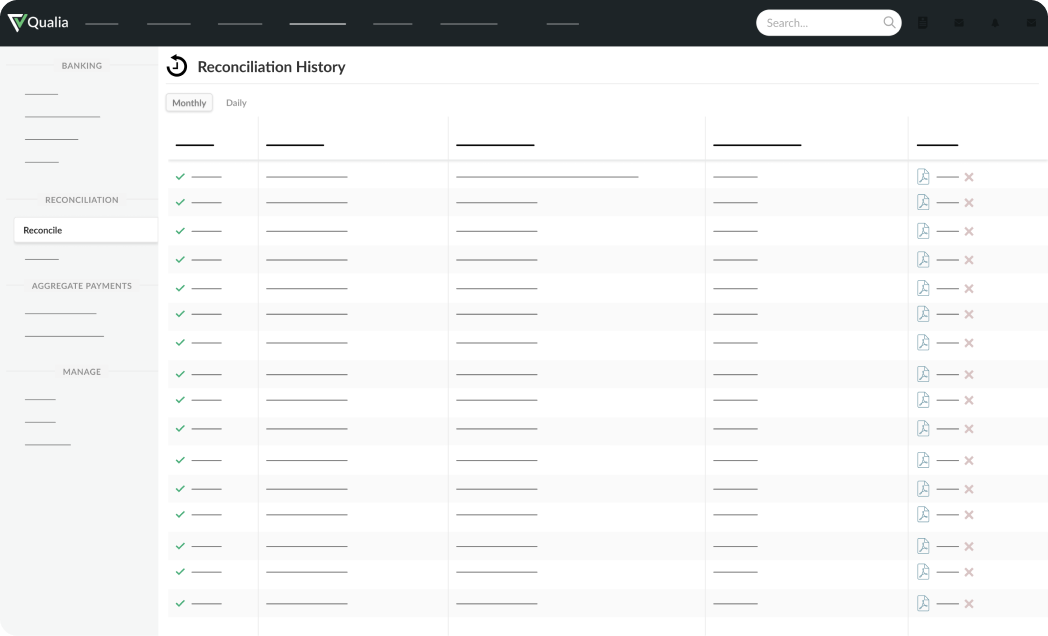

At month’s end, a Qualia Reconciliation Specialist will help you clear any remaining exceptions and finalize reconciliations for all your bank accounts in minutes, not hours.

A Reconciliation Specialist will research, match and clear your accounting exceptions daily in Qualia. If they don’t have enough information to resolve an exception, you’ll be notified that day.

Our Specialists average 9 years of accounting experience and are deeply knowledgeable about Qualia’s accounting functionality.

Clients who use the Bank Partner Network and meet minimum average daily balance requirements may be eligible to waive bank fees and receive credits that offset the cost of Qualia products and services.

Work with a banking support team tailored to your industry-specific needs, who is highly knowledgeable about both Qualia products and title and escrow.

“I cannot say enough good things about the Reconciliation Specialists. Our Reconciliation Specialist was amazing coming in and figuring out what all these large transfers were. She cleaned up all of our accounts in no time.”

Jennifer Mulling, Operations Manager, Global Title

Unlike other software that takes 10-15 minutes to match your system of record, Qualia updates in real time. Because it’s integrated, Qualia will instantly flag file shortages, stale overages, outstanding credits, and outstanding lienable items.

Your Reconciliation Specialist will provide a daily update to your in-app inbox on any exceptions they’re not able to match with the information at hand, and alert you to any suspicious activity.

Easily leave an audit trail with notes on accounting items. Assign tasks or tag team members when accounting items require follow up.

Once you’ve identified an accounting item that requires your attention, navigate to the relevant order quickly with hyperlinks, right inside your system of record.

This package of Significant Audit Findings Reports (SAFER) includes: cleared status of debits & credits, aged remaining & negative balances, uncleared disbursements, and exceptions.

Qualia’s automatic clearing functionality clears items by intelligently matching transactions that have cleared your bank account to items that are posted in Qualia.

When you open a new bank account with one of our bank partners, you’ll get a 24/7 online banking portal, extended service hours & wire cutoff, a complementary check purchasing program, and FED reference numbers in 3 minutes.

Qualia Reconciliation Specialists are experts in ALTA best practices. To meet those standards, specialists will facilitate daily two-way reconciliations, monthly three-way reconciliations, and provide readily available supporting documentation.

A dedicated Reconciliation Specialist is not only an expert in navigating Qualia, they will also serve as an accounting advisor, and help to train your staff on ALTA best practices.

Get in touch with the Qualia team to learn more about our Reconciliation Service