Gain Visibility and Increase Efficiency

Gain approved access to your agents’ books with secure single sign-on and deliver title products instantly with automated document tracking

Instantly place orders with title partners and give clients access to real-time progress updates and paperless, error-free closings

Build and deliver custom, on-brand, and modern closing experiences using Qualia’s flexible infrastructure

Scale your underwriting business with modern title agency management and operations all in one place

Leverage a turn-key distribution platform that gives you instant access to thousands of clients

Get the transparency, speed, and real-time communication you want when purchasing or refinancing a home

Related Resources

Gain Visibility and Increase Efficiency

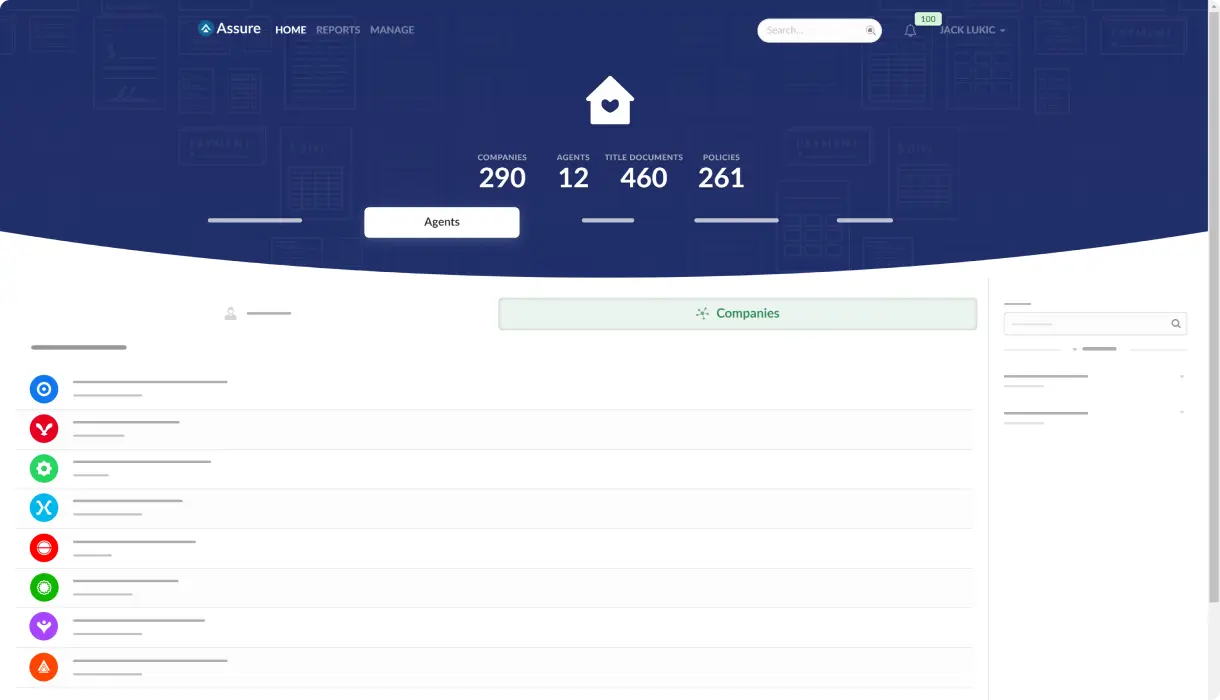

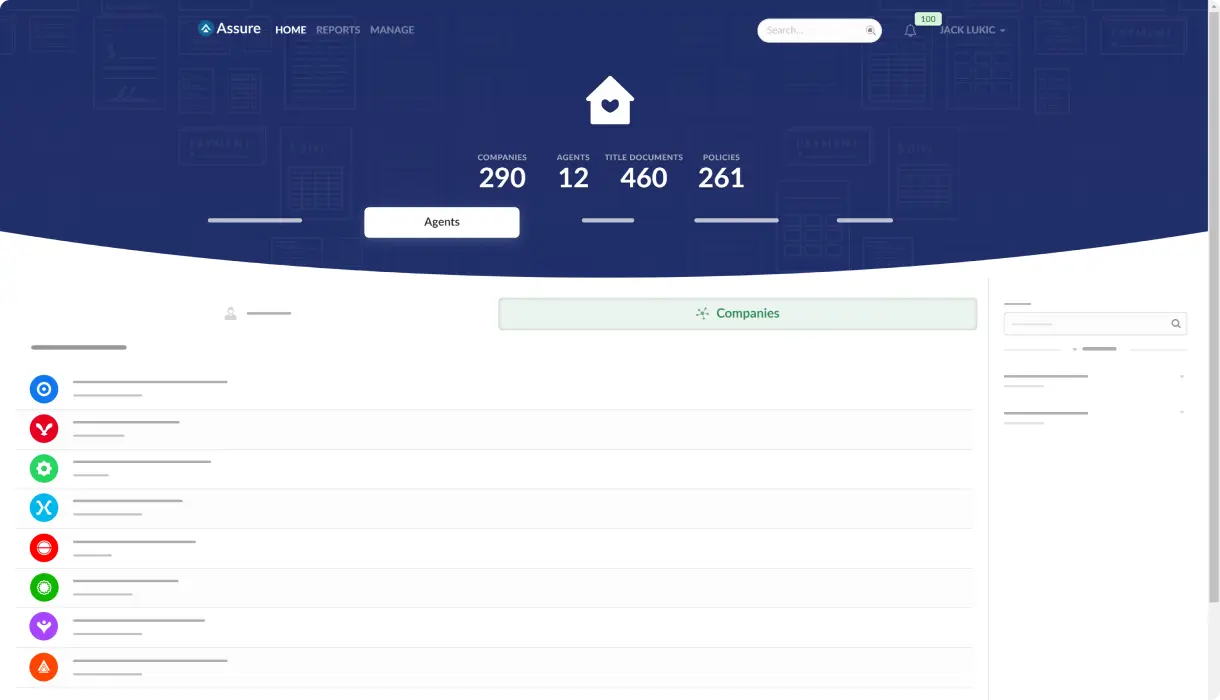

Gain approved access to your agents’ books with secure single sign-on and deliver title products instantly with automated document tracking

Attract New Title Agencies

Unlock new prospective customers from a vast network of title companies who use Qualia for title production

Focus on Your Business, Not Your Software

Eliminate the need for costly, inefficient underwriting software and maintenance

Reduce errors and speed up the closing process. Information is sent directly from the title agency’s system so agents no longer need to enter data more than once or switch between software systems.

Access files within an audit period and request documents for review online. Eliminate the need to email documents since file sharing happens seamlessly between Assure and Qualia’s title production software systems.

Automatically compare payments to copies of final policies and analyze remittances to ensure accuracy.

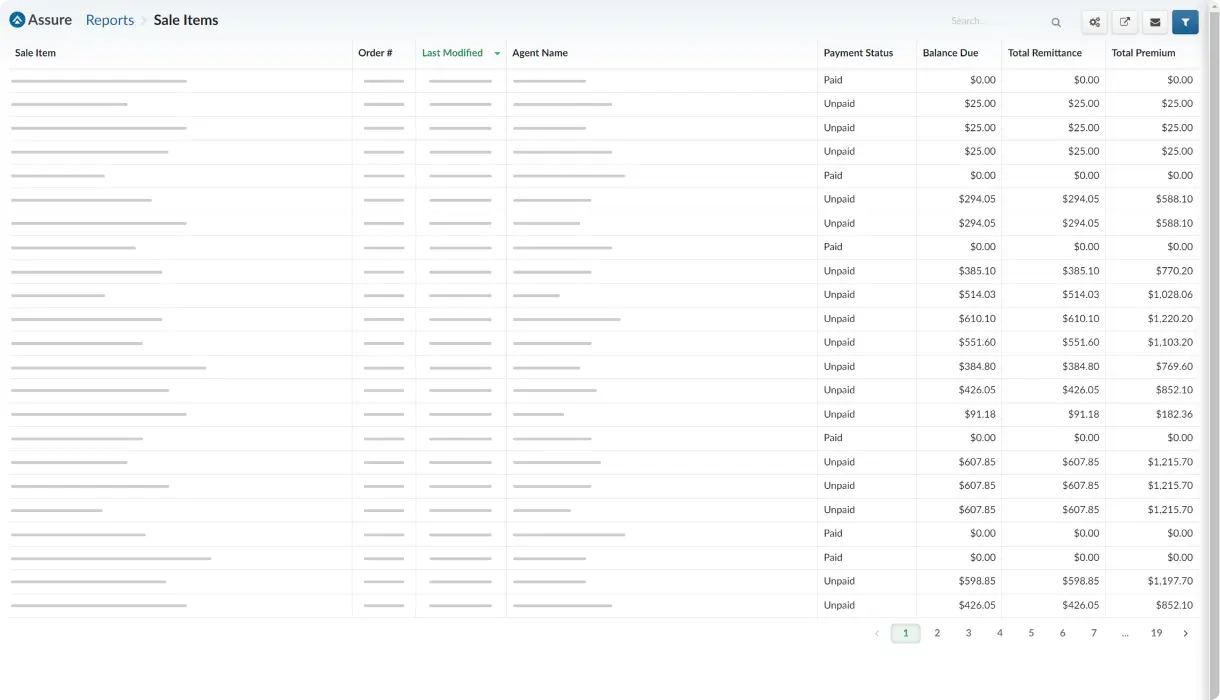

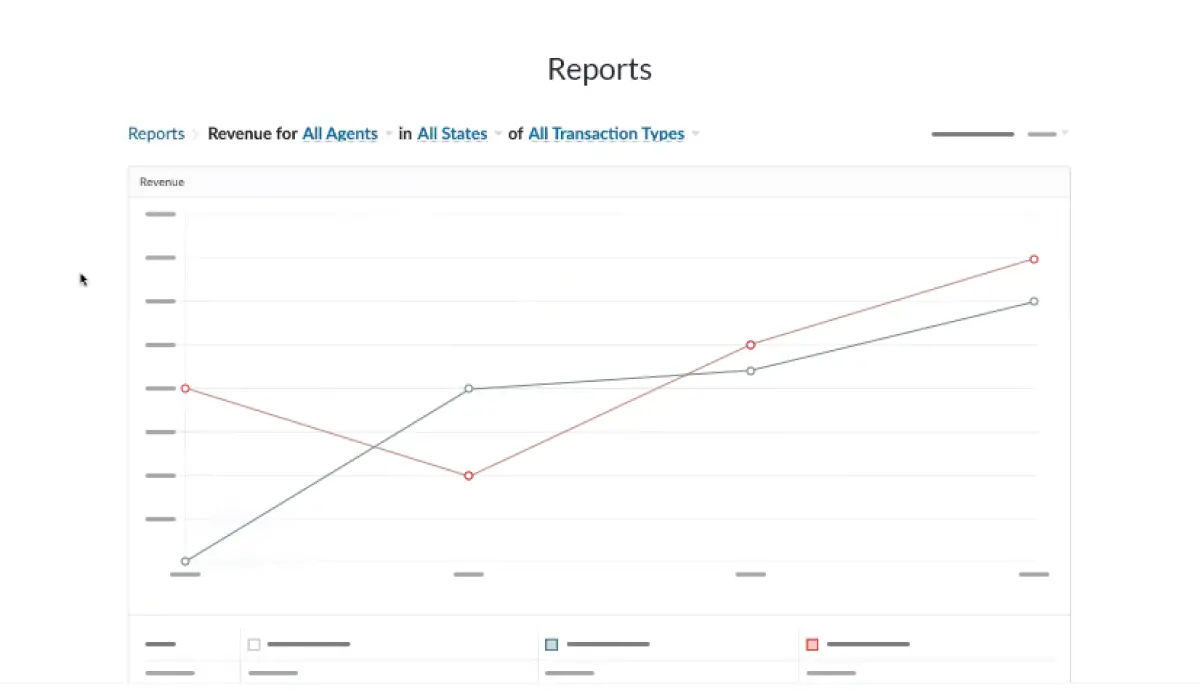

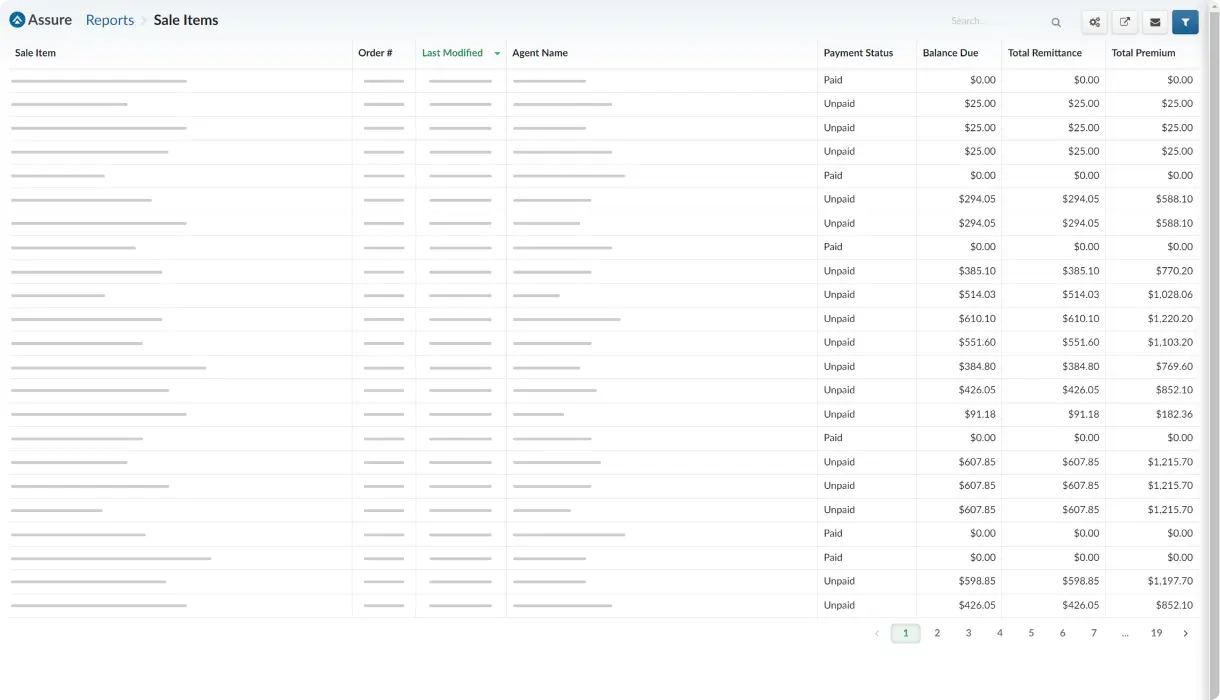

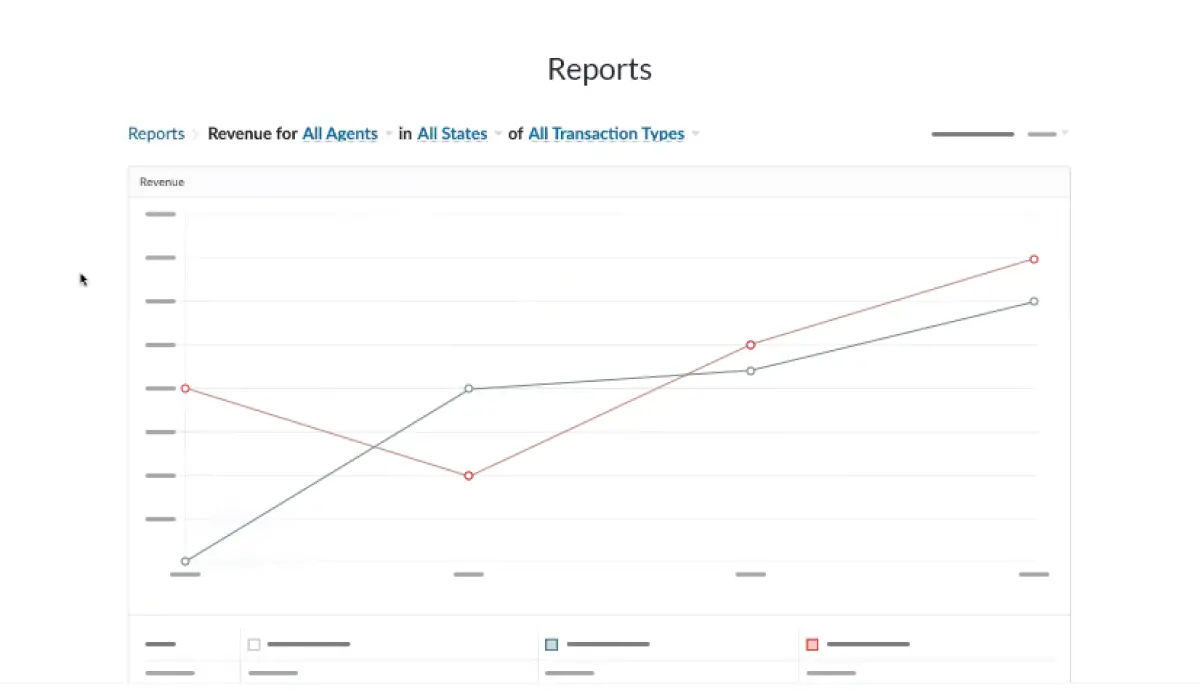

Report on actual vs. estimated revenue and premium, outstanding remittances, agency splits, as well as product usage. Generate custom reports, including critical financial reports.

Get discovered by new potential title agent clients using Qualia who see the differential benefit of working with an Assure-powered underwriter.

You own your data, Qualia keeps it secure. Assure meets the international standards for comprehensive security management. Qualia has ISO 27001 certification and an updated SOC 2 Type II report.

“Assure streamlined the process of the agents being able to access our documents whenever they needed them. They know what to expect, and we have immediate knowledge if there is an issue. Sometimes it’s even before the agent has become aware of an issue, before there would have to be any corrections down the road.”

Portia Lipani, Escrow Officer, Pulsar Title Insurance Company

Deliver rates, policy jackets, and CPLs directly to title agents using Qualia’s software with out-of-the-box integrations.

Transfer remittances via ACH and report on final policy remittance data.

Collect and automatically analyze monthly reconciliations. Automatically flag specific issues like negative trial balance, outstanding payoff checks, and outstanding premium checks.

Report on actual vs. estimated revenue and premium, outstanding remittances, agency splits, product usage, and custom reports, including financial reporting.

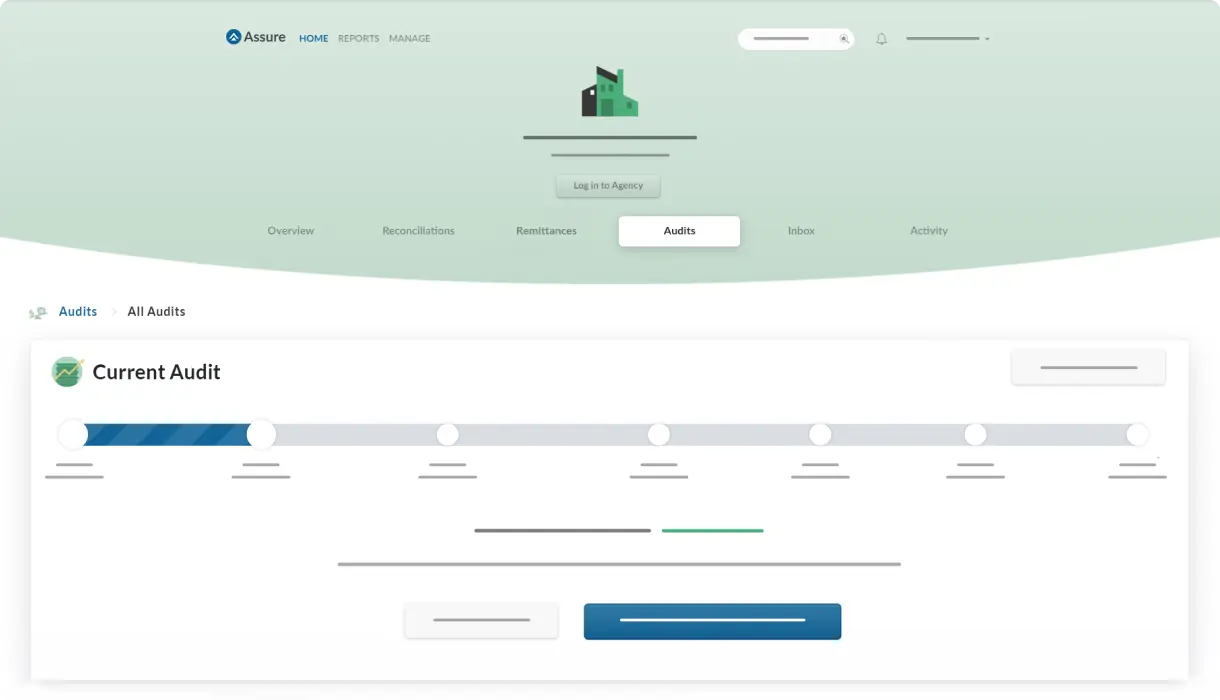

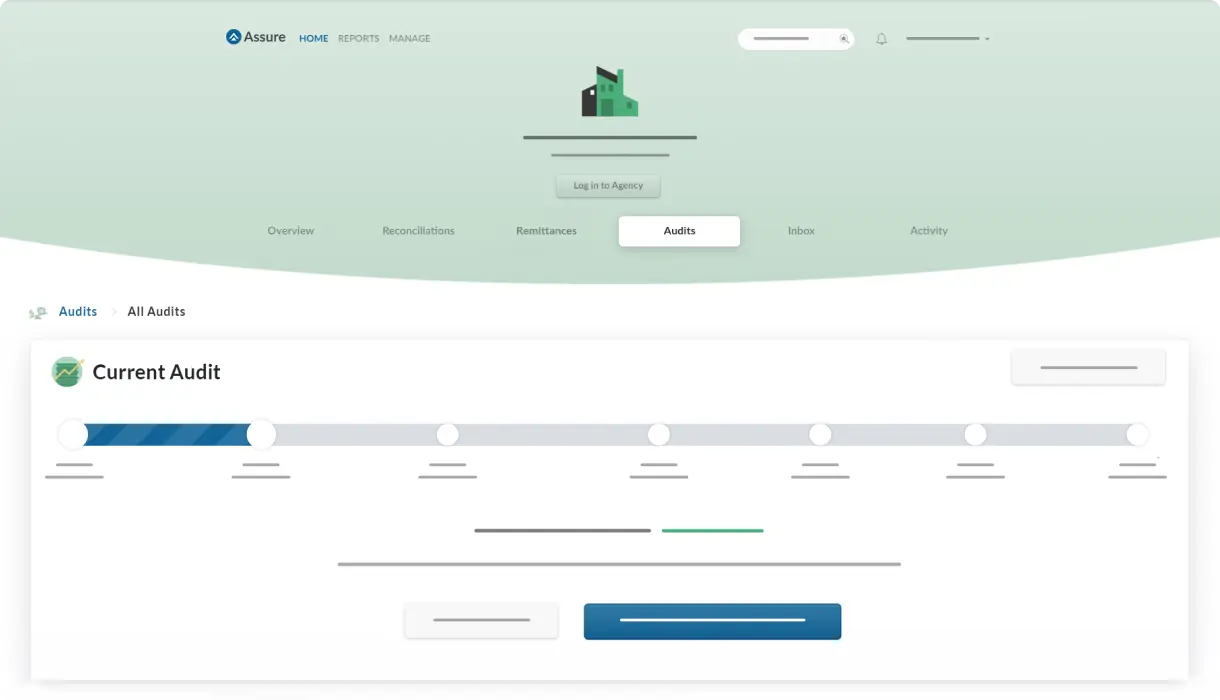

Auditors can complete an end-to-end audit, including file review, from Assure. Use built-in intelligence to flag potential audit violations.

Underwriting rules trigger automatic file reviews. Program custom underwriting rules and configure policies for individual agents.

View detailed file status including CPL and policy status with enhanced integration.

Customize forms and allow agents to access forms packages.

View and download full policy copies, including schedules when enhanced integrations are turned on.

Get in touch with a member of the Qualia team to learn more about Assure